Worried About Inflation?

SWP in Mutual Fund Can Secure Your Monthly Cash Flow – Learn How

Want tax-efficient retirement income? Explore how SWP in mutual fund minimizes taxes while providing steady payouts. Read our expert 2025 guide today

When it comes to managing cash flow, preserving capital, and beating inflation — especially in the retirement phase — one strategy stands tall: SWP in Mutual Fund

For decades, we’ve been taught to focus on saving and investing.

But very few talk about the next critical step — how to withdraw from your investments wisely.

Managing your wealth after accumulation is just as important as building it.

Today, I’ll walk you through everything you need to know about SWP in Mutual fund , including how it can create a stable, tax-efficient, inflation-beating cash flow — especially crucial during retirement or financial independence.

I’m going to explain everything about SWP (Systematic Withdrawal Plan ) — in simple, real-world terms — the same way I explain to my clients during personal consultations.

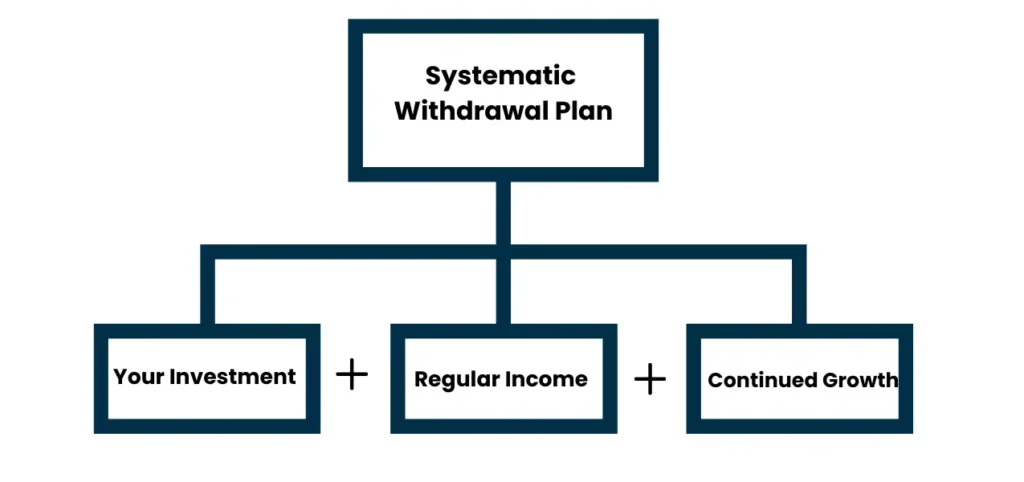

1. What is Systematic Withdrawal Plan?

A Systematic Withdrawal Strategy allows you to withdraw a pre-decided amount from your mutual fund investments at regular intervals — monthly, quarterly, or annually — while your remaining investment continues to stay invested and grow.

In simple words:

Think of it as setting a monthly salary for yourself, but the employer is your own money

Key Features of Systematic Withdrawal Strategy

- Flexible withdrawal amount and frequency.

- Remaining corpus continues to earn returns.

- No need to redeem entire investment at once.

- You control your income and taxes better.

2) Why is Systematic Withdrawal Important?

- Creates a predictable monthly income from your investments.

- Manages cash flows smartly during retirement or financial goals.

- Beats inflation as the balance amount stays invested and grows.

- Tax efficiency: You pay tax only on gains, not the full withdrawal.

- Protects principal: If designed carefully, your original investment can last a very long time.

- Peace of mind: No need to redeem lump sums or time the market.

In short, SWP gives you control, peace, and discipline.

3. How Does Regular Payout Method Work?

Let’s break it down step-by-step for smart financial planning:

Step 1: Create a Corpus First

Before you start withdrawing through SWP, you must build a strong investment corpus.

You can create this corpus through:

- Systematic Investment Plans (SIP): Small regular investments to accumulate wealth over years.

- Lump Sum Investments: One-time larger investments when you have surplus money.

The idea is to patiently grow your investments over time — choosing suitable mutual funds (debt, hybrid, or equity based on your time horizon and risk appetite).

Step 2: Decide a Sustainable Withdrawal Rate

Once your corpus reaches a meaningful size, you can start a Systematic Withdrawal Plan (SWP).

Here, you decide:

- How much to withdraw (say, ₹25,000 per month)

- How frequently to withdraw (monthly, quarterly, annually)

🔵 Golden Rule:

“Your withdrawal rate should ideally be less than your fund’s expected return rate, to ensure your money lasts longer.”

Why?

- If you withdraw too much compared to the returns generated, your corpus will deplete quickly.

- A sustainable withdrawal allows the remaining corpus to grow, even after regular withdrawals.

Step 3: Systematic Redemption

Every month (or as chosen), the fund will redeem the exact number of units required to match your fixed withdrawal amount.

The number of units redeemed will depend on the prevailing NAV (Net Asset Value) at that time.

Step 4: Remaining Corpus Keeps Growing

The units that are not redeemed remain invested in the mutual fund.

They continue to participate in market growth — helping you:

- Beat inflation

- Generate higher returns

- Increase longevity of your portfolio

Thus, Systematic Withdrawal Strategy creates a balance between enjoying regular income and letting wealth grow.

Practical Example with Numbers: Sustainable Withdrawal

Imagine:

- You built a corpus of ₹50 lakh over 10 years via SIPs and a few lump sum investments.

- You plan to start your regular payout method from a debt mutual fund expected to deliver 7% annual returns.

Now:

- 7% return on ₹50 lakh = ₹3.5 lakh/year = ~₹29,000/month

- To ensure your corpus grows/stays stable, your withdrawal should ideally be ₹20,000 to ₹25,000/month, not full ₹29,000.

This way:

- Part of the return covers your withdrawals.

- Rest of the return (2-3% approx.) allows the corpus to still grow modestly.

- Inflation protection and capital safety are maintained.

If you withdraw ₹30,000 or more, over time, your corpus will start shrinking.

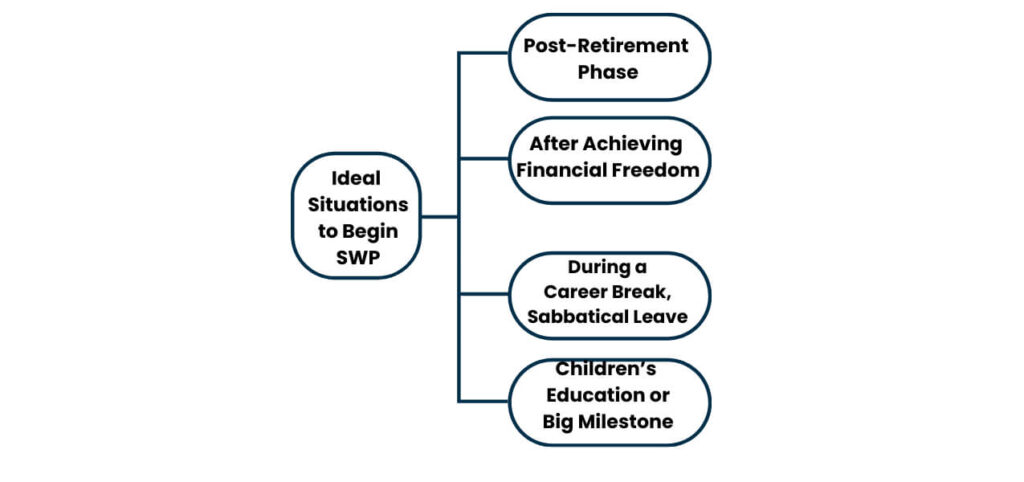

4. When Should You Start SWP? (Strategic Timing Matters)

Starting an Systematic Withdrawal Strategy at the right time is critical to maximize the power of compounding and ensure long-term financial sustainability.

Here’s when it is ideal to start:

Post-Retirement Phase

When your regular salary income stops, Systematic Withdrawal Strategy can offer a steady, tax-efficient income stream without liquidating your entire investment.

To make this even more effective, many retirees structure their savings using a Retirement Bucket Strategy

After Achieving Financial Freedom

If you have accumulated sufficient corpus and no longer depend on a job for income, you can start SWP to fund your lifestyle needs comfortably.

During a Career Break, Sabbatical, or Maternity Leave

When you take planned time off work, an SWP can help cover monthly expenses without disturbing your long-term investments.

Funding Children Education or Big Milestone Expenses

When you take planned time off work, an SWP can help cover monthly expenses without disturbing your long-term investments.

Important Golden Rules Before You Start

- Do NOT Start SWP Until You Actually Need Funds

Many investors make the mistake of activating SWP immediately after creating a corpus — even if they don’t need the money yet.

Better Approach:

- Let your investments stay untouched and compound longer.

- The longer you allow the corpus to grow, the higher your future monthly withdrawal amount can be.

- Compounding works exponentially over time; withdrawing early can rob you of this powerful advantage.

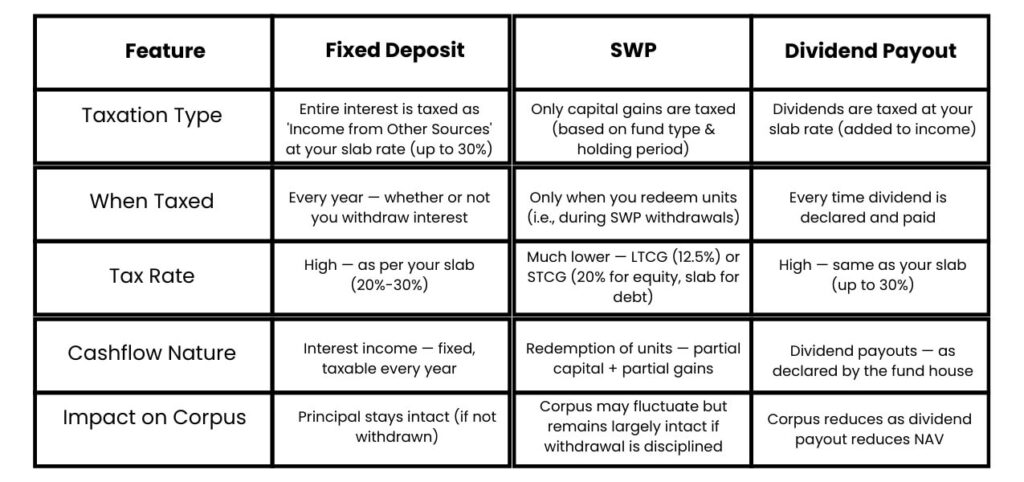

5. How SWP is Tax Efficient vs. Fixed Deposit Interest and Dividend Payout (IDCW)?

When planning regular cashflows from investments, taxation plays a huge role in determining your real (post-tax) returns.

Let’s carefully compare Fixed Deposit (FD), SWP, and Mutual Fund Dividend (IDCW) options

Key Observations:

Fixed Deposit (FD) :

- All interest, even if you don’t withdraw it, is taxed every year.

- Heavy tax outgo if you are in 20%-30% bracket.

- Poor post-tax returns

SWP:

- Only capital gains portion is taxed during each redemption.

- If you redeem principal, no tax on principal part.

- Lower effective tax especially if holding is >1 year (LTCG (Long Term Capital Gain) benefit in equity funds).

Dividend Payout (IDCW):

- Dividends declared by the mutual fund are added to your total taxable income.

- No preferential tax treatment — full dividend taxed at slab rates.

- Worse for high-income individuals (30% slab).

6.How SWP Works in Debt, Hybrid, and Equity Funds (and Tax Implication)

SWP (Systematic Withdrawal Plan) can be started from any mutual fund category — Debt, Hybrid, or Equity — but the working and taxation differ slightly across each.

Here’s a full breakdown

1. Debt Mutual Funds

Investments: Primarily in bonds, government securities, and money market instruments.

SWP Benefit: Provides stable and predictable withdrawals.

Volatility & Growth: Less volatile, but offers lower growth potential compared to equity.

Taxation (Post-July 2023):

Taxed like fixed deposits.

As per income slab rate, without indexation benefits.

2. Hybrid Mutual Funds

- Investments: Combination of equity and debt.

- SWP Benefit: Delivers moderate, inflation-beating cash flows with lower volatility than pure equity funds.

- Risk & Return: Balanced risk-return profile. Ideal for conservative investors seeking regular income.

- Taxation:

- A)Held >1 year: Long-Term Capital Gains (LTCG) taxed at 12.5% beyond ₹1.25 lakh annual gain.

B)Held <1 year: Short-Term Capital Gains (STCG) taxed at 20%

3. Equity Mutual Funds

- Investments: Minimum 65% allocation to equities (stocks).

- SWP Benefit: May show NAV fluctuations, but suited for long-term wealth creation and inflation-beating returns.

- Volatility & Growth: Higher volatility, but best potential for long-term growth.

- Taxation:

- Held >1 year: LTCG taxed at 12.5% beyond ₹1.25 lakh annual gain.

- Held <1 year: STCG taxed at 20%.

Pro Financial Planner Tip:

If you’re planning SWP for longer durations (10-20 years),

Start with equity or aggressive hybrid funds,

Hold at least 12 months before starting SWP,

Keep annual capital gains within ₹1.25 lakh to enjoy zero tax legally.

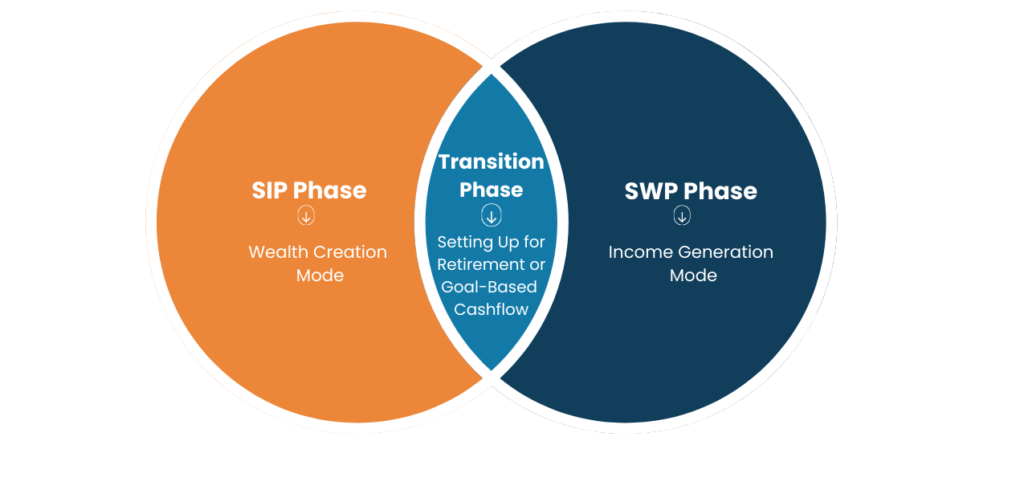

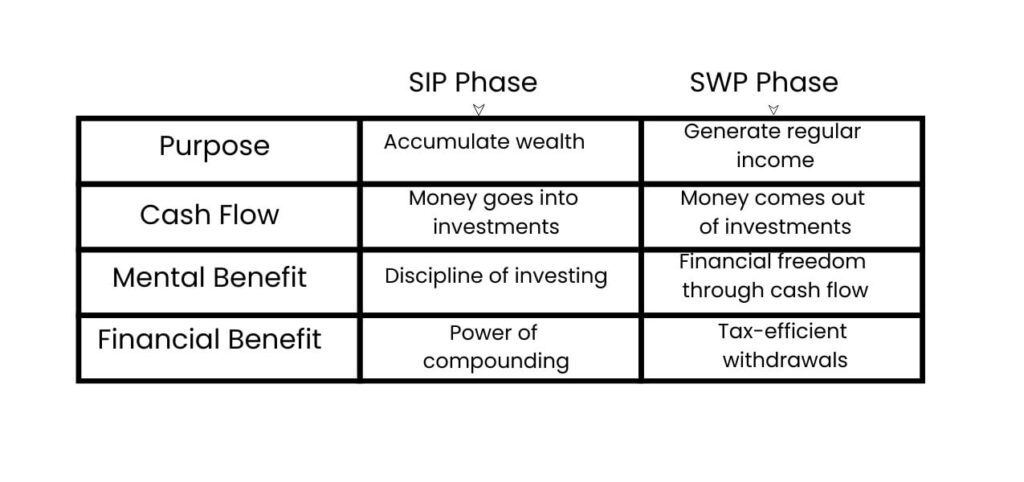

7.SIP + SWP Combo: A True Wealth Game Changer

SIP (Systematic Investment Plan):

A disciplined way to build wealth over time by investing a fixed amount regularly into mutual funds.

SWP (Systematic Withdrawal Plan):

A smart strategy to generate regular cash flows by systematically withdrawing a fixed amount from your investments.

How the SIP + SWP Combo Works

1. SIP Phase – Wealth Creation Mode

- Start SIPs early in equity or hybrid mutual funds during your active income years.

- Benefit from rupee-cost averaging and power of compounding.

- Build a sizeable corpus over 10-20 years.

2. Transition Phase – Setting Up for Retirement or Goal-Based Cashflow

- As you approach retirement or a goal (children’s education, sabbatical), review and rebalance your corpus.

- Gradually shift a portion from high-risk (pure equity) to more stable (hybrid or debt funds) assets.

3. Systematic Withdrawal Plan Phase – Income Generation Mode

- Set up SWP from the matured corpus for regular monthly/quarterly withdrawals.

- Keep a portion of your funds invested (not fully withdrawn) to continue compounding returns.

- Plan your SWP withdrawal rate lower than the expected fund return to keep the corpus sustainable.

Why SIP + SWP Combo is Powerful

Key Advantages of Systematic Investment Plan + Systematic Withdrawal Plan Combo

- Seamless Transition from wealth creation to wealth distribution.

- Reduces Risk: Since you’re not redeeming lump sum at once, market volatility impact is minimized.

- Tax Efficiency Planning : SWP attracts only capital gains tax (which can be very low) compared to FD interest or dividends.

- Compounding Continues: Only a part of the corpus is withdrawn — the remaining continues to grow.

- Inflation Beating: You can adjust your SWP amount annually to keep pace with inflation.

Illustrative Flow :

- Age 30–50 → ₹20,000 SIP → Equity funds → Corpus grows to ₹2 crore

- Age 51 → Gradual shift to Hybrid Funds

- Age 55 → Start SWP of ₹70,000 per month

9.Protecting Your Retirement Income from Inflation

One of the biggest risks in retirement or passive income planning is inflation.

In India, the long-term average inflation typically hovers around 6%–7%.

If you continue withdrawing a fixed SWP amount year after year, your purchasing power shrinks drastically over time.

The Problem with Fixed Systematic Withdrawal Plan

- ₹35,000 per month today might feel sufficient.

- But 10 years later, due to inflation, you might need ₹55,000–₹60,000 to maintain the same lifestyle.

- If your SWP is not inflation-adjusted, you risk downgrading your lifestyle.

The Smart Solution: Annual SWP Increment (Inflation-Proofing)

Action Plan:

Increase your withdrawal amount by 5%–7% every year.

Align your withdrawal growth rate roughly with inflation

Key Takeaway:

- Plan for inflation right when you set your Systematic withdrawal strategy.

- Start with a slightly lower withdrawal if needed, but build-in yearly step-ups.

- Review corpus performance annually to ensure it can support rising withdrawals sustainably.

- Consider keeping an emergency fund outside of SWP to avoid touching your core investments during bad market years.

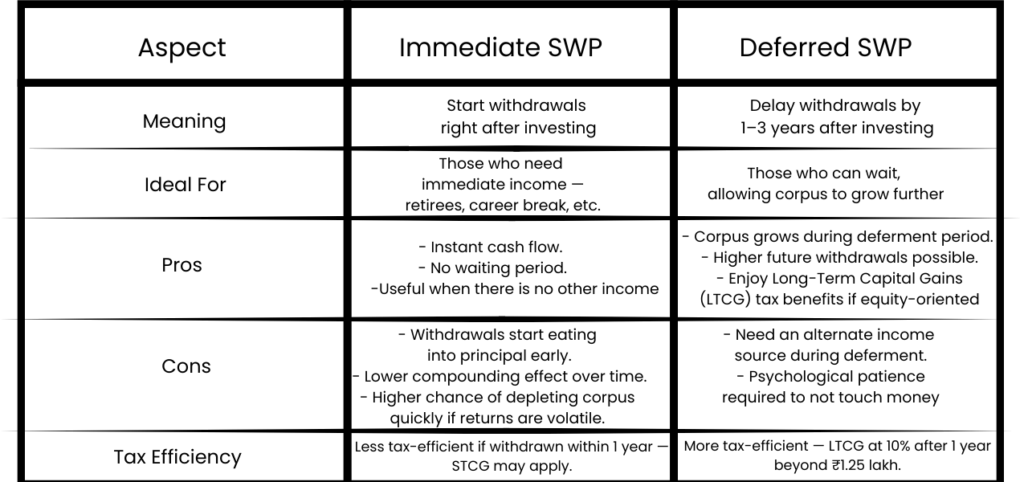

10. Immediate vs. Deferred SWP: Which is Better?

When setting up an SWP, one crucial decision is — Should you start withdrawals immediately or defer them?

Let’s understand both options carefully

Example:

- Immediate SWP:

Invest ₹50 lakh → Start ₹40,000 monthly SWP → Corpus depletes faster if market return < withdrawal rate. - Deferred SWP:

Invest ₹50 lakh → No withdrawal for 2 years → Corpus grows to ₹56 lakh → Higher sustainable SWP possible at ₹45,000 monthly with lesser stress.

11.How systematic withdrawals work during Retirement

Retirement Planning isn’t just about savings —

it’s about creating a smart, reliable income stream without worrying about running out of money.

A carefully planned SWP acts like a custom pension, offering multiple benefits:

Key Advantages of Systematic Withdrawal Strategy in Retirement

- Stable Monthly Income:

Your investments systematically pay you a fixed amount every month — just like a salary! - Capital Appreciation:

Unlike fixed pensions, your remaining corpus continues to grow over time, helping your wealth beat inflation. - Tax-Efficient Withdrawals:

You pay tax only on the gains portion, making SWP far more tax-friendly than traditional fixed deposits. - Flexibility & Control:

You can increase, decrease, or pause withdrawals depending on your needs — complete control remains with you. - Inflation Protection:

With the right fund choice (equity/debt mix), your corpus stays aligned with rising living costs.

FAQ:

In an SWP, a specified number of mutual fund units are redeemed at regular intervals to provide the desired payout. The number of units redeemed depends on the withdrawal amount and the Net Asset Value (NAV) of the fund at the time of withdrawal.

SIP helps you invest regularly in a mutual fund.

STP lets you shift money periodically from one fund to another.

SWP allows you to withdraw money regularly from your fund.

SIP is for accumulation, STP is for investment strategy, and SWP is for income.

Yes, SWPs are often used as a tool for retirement planning. They provide a predictable tax efficient income stream, allowing retirees to manage their expenses while keeping the remaining corpus invested.

The minimum investment amount for initiating an SWP varies across mutual fund schemes and Asset Management Companies (AMCs). For instance, some funds may require a minimum balance of ₹5,000 to start an SWP.

Yes, most mutual funds allow investors to modify, pause, or cancel their SWP. The process typically involves submitting a written request or making changes through the fund’s online portal.

SWP can offer higher post-tax returns and capital appreciation potential compared to FDs, but it carries market risk. FDs provide guaranteed returns but often lower than inflation.

Yes. Once your SIP has accumulated a sizable corpus, you can start an SWP from the same mutual fund scheme or switch to a more stable fund before doing so.

Yes, the withdrawal amount remains fixed for each installment. However, the number of mutual fund units redeemed may vary depending on the NAV on the withdrawal date.

Contact Us

Table of Contents

Vineet Baheti , CFP

With over 14 years of experience in wealth management, I am expertise in comprehensive financial planning, including tax planning, retirement planning, and goal-based planning for High-Net-Worth (HNI) and Ultra-High-Net-Worth (UHNI) clients. As a Certified Financial Planner (CFP, Certification Number: IN94288), I provide personalized strategies to help clients achieve financial security, optimize their tax positions, and plan for a prosperous retirement. My approach is centered around building tailored financial plans that align with individual’s unique goals, ensuring their long-term financial success.