Financial Planning for Millennials: 9 Smart Money Moves

Millennials are facing a financial world that’s very different from the one our parents knew. With the rising cost of living, student loans, gig economy jobs, and social pressure to “live your best life,” planning for the future often takes a back seat.

But you can change that—starting today.

In this blog, we’ll walk through 9 smart and simple financial planning tips for millennials that can help you build wealth, stay out of debt, and create the life you want.

A Personal Note from Me

_“When I got my first job at 23, I was just excited to finally earn money. I didn’t have a budget, didn’t track my expenses, and definitely didn’t think about investing. Most of my salary went toward eating out, weekend getaways, and online shopping. Saving felt optional.

But when a family emergency came up two years later, I had to borrow money — and that was my wake-up call. I felt helpless, even though I was earning well. That’s when I started learning about emergency funds, SIPs, and long-term planning.

Today, I still enjoy life, but I also have a clear budget, a growing emergency fund, and investments for future goals like buying a home and retirement. I’m not perfect, but I’m in control — and that makes a huge difference.”_

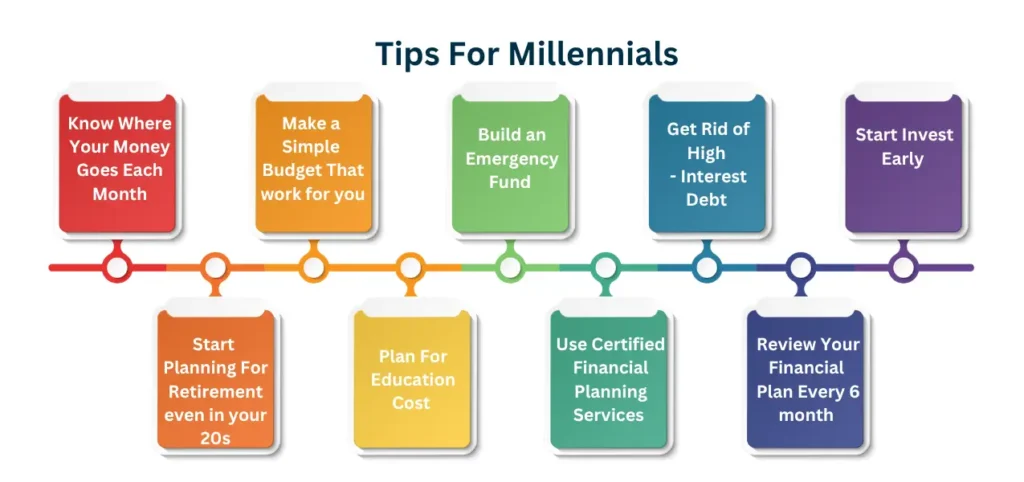

Financial Planning Tips For Millennials

1. Know Where Your Money Goes Each Month

Before you can make a financial plan, you need to know where your money is going.

Start by writing down:

How much you earn

What you spend on essentials (rent, bills, transport, groceries)

What you spend on extras (eating out, online shopping, movies)

How much you owe in loans or credit cards

How much you save or invest (if at all)

Seeing your spending habits clearly will help you cut waste and plan better.

2.Make a Simple Budget That Works for You

Budgeting isn’t about giving up everything you enjoy. It’s about spending wisely and saving for what truly matters.

Try the 50/30/20 Rule:

- 50% on Needs: Rent, food, bills

- 30% on Wants: Travel, gadgets, entertainment

- 20% on Savings or debt payments

Automate your savings. Set up automatic transfers to your savings or investment accounts the day your salary comes in.

3. Build an Emergency Fund (Your Safety Net)

An emergency fund is money saved for sudden events like:

- Job loss

- Accidents or medical needs

- Home or car repairs

Goal: Save 3 to 6 months’ worth of basic expenses.

Example: If your monthly expenses are ₹25,000, try to build an emergency fund of ₹75,000–₹1,50,000.

Keep it in:

- A high-interest savings account

A liquid mutual fund and arbitrage fund (safe and easily accessible)

4. Get Rid of High-Interest Debt

Debt can feel heavy, especially when interest keeps growing.

Make a plan:

- List your debts: how much you owe, and the interest rate

- Use the Avalanche Method: Pay off the highest-interest debt first

- Or the Snowball Method: Pay off the smallest debt first to build momentum

- Avoid taking loans for things like mobile phones or vacations.

5. Start Investing Early – Even Small Amounts Matter

Saving is great, but investing helps your money grow faster than just keeping it in a bank.

Start with Mutual Funds through SIPs (Systematic Investment Plans).

How it works:

- You invest a fixed amount every month (like ₹500 or ₹1,000)

- That money goes into a mutual fund

- Over time, your investment grows due to compounding

Example:

₹2,000/month invested in a good mutual fund at 12% annual return for 15 years = Over ₹10 Lakhs!

Start small and increase your amount as your income grows.

6. Start Planning for Retirement — Even in Your 20s

Retirement may seem far away, but the earlier you start saving, the easier it becomes.

Why start now?

- The money you invest now has more time to grow

- You can start with small monthly amounts

- You won’t feel stressed in your 40s or 50s

Best options in India:

- NPS (National Pension System): A government-backed retirement scheme with tax benefits

- Long-term Mutual Fund SIPs: Great for building a retirement corpus over 20–30 years

Example:

If you start saving ₹3,000/month at age 25, and earn 10–12% returns, you could build ₹1 crore+ by age 60.

Learn more about Early Retirement Plan

7. Plan for Future Education Cost

Whether it’s for your own higher education or for your future kids, education is a big goal — and a big expense.

Tuition fees are rising every year. Loans can help, but planning ahead is smarter.

Here’s what you can do:

- Start a goal-based SIP for education (5–10 year horizon)

- Consider child education plans (if you’re a parent)

- Use mutual funds for flexibility and better growth

Start early. The earlier you save, the less you need to invest monthly.

Learn more about Financial Planning for Education

8. Use Financial Planning Services (Get Expert Help)

If you feel confused or stuck — that’s okay.

Certified Financial Planner can help you:

- Understand your money better

- Set short- and long-term goals

- Choose the right investment options

- Plan for taxes and life events

Always choose a trusted and certified advisor.

9. Review Your Financial Plan Every 6 Months

Your financial situation won’t stay the same — and your plan shouldn’t either.

Over time, your life can change in big ways:

- You may switch jobs

- Get married or start a family

- Move to a new city

- Take on new financial responsibilities

That’s why it’s important to review your plan regularly. As part of financial planning for millennials, staying updated helps you stay on track and avoid surprises.

Set a calendar reminder every 6 months to:

- Check your budget – Are you spending too much or saving too little?

- Review SIPs and mutual fund performance – Are your investments aligned with your goals?

- Update your goals – Are you still working toward the same things, or have your priorities shifted?

- Adjust insurance and emergency funds – Do you need more coverage based on your current lifestyle?

If you haven’t already, consider switching to a goal-based financial planning approach— where every investment, SIP, or savings decision is linked to a specific life goal (like buying a house, planning a wedding, or early retirement). This makes your money work with purpose.

Bonus Tip: Track your Net Worth (Assets – Liabilities) every 6 months. It’s one of the simplest ways to measure real financial progress. Also you can use Financial Calculators.

Why These 9 Smart Money Moves Matter

1. Peace of Mind

By budgeting, building an emergency fund, and reviewing your finances regularly, you reduce anxiety about unexpected expenses.

2. Financial Freedom

With proper planning, SIPs, and goal-based investing, you won’t need to rely on debt — you’ll build wealth on your terms.

3. Clarity on Your Life Goals

Whether it’s buying a home, starting a business, or early retirement — these moves align your money with your dreams.

4. Confidence in Every Financial Decision

Understanding mutual funds, insurance, and tracking your net worth helps you make informed decisions — not emotional ones.

5. Stronger Future for You & Your Family

From education planning to retirement savings, these steps protect your loved ones and secure long-term success.

Final Thoughts: Your Financial Future Starts with One Small Step

Don’t wait for a perfect salary, perfect job, or perfect moment.

Start small. Start now.

Your future self will be thankful.

“You don’t need to be rich to start. But you need to start to get rich.”

Financial planning helps millennials manage student debt, build savings, invest early, and make informed decisions about spending and future goals like homeownership or retirement.

Start by tracking income and expenses, creating a realistic budget (like the 50/30/20 rule), building an emergency fund, and paying down high-interest debt.

Common challenges include student loans, rising housing costs, job market volatility, and pressure to keep up with lifestyle trends (aka lifestyle inflation).

A good starting point is saving 20% of your income — which can go toward emergency savings, retirement, and investments. The exact amount depends on your income and goals.

Yes. Starting early — even with small amounts — can take advantage of compound growth. Robo-advisors and low-cost index funds make it easier than ever.

It depends. For some, renting offers flexibility. For others, owning a home is a long-term wealth-building strategy. Evaluate your finances and lifestyle plans first.

Building an emergency fund (3–6 months’ expenses), paying off debt, and starting retirement savings are key early goals.

Use budgeting strategies like the 50/30/20 rule to allocate for both fun and financial security — it’s about balance, not restriction.

Common pitfalls include ignoring high-interest debt, delaying retirement savings, overspending on lifestyle upgrades, and not having insurance or an emergency fund.

Yes — especially fee-only Planning or digital platforms that cater to young professionals. They can help you set clear goals and avoid costly mistakes.

Contact Us

Table of Contents

Vineet Baheti,CFP

With over 14 years of experience in wealth management, I am expertise in comprehensive financial planning, including tax planning, retirement planning, and goal-based planning for High-Net-Worth (HNI) and Ultra-High-Net-Worth (UHNI) clients. As a Certified Financial Planner (CFP, Certification Number: IN94288), I provide personalized strategies to help clients achieve financial security, optimize their tax positions, and plan for a prosperous retirement. My approach is centered around building tailored financial plans that align with individual’s unique goals, ensuring their long-term financial success.