Retire Confidently by Managing Cash Flow in Retirement the right way

Attention: Are You Ready to Retire Without Running Out of Money

You’ve worked hard, raised a family, paid off your debts, and built your savings. Now, as retirement approaches—or has already begun—you’re entering a phase where your money must work for you, not the other way around.

If you believe retirement is just about accumulating wealth, think again. The real challenge begins when your monthly salary stops and managing cash flow in retirement becomes essential to ensure your savings and investments support your lifestyle and long term needs.

Why Does Cash Flow Matter in Retirement?

Because the ability to manage your monthly inflow and outflow determines whether you live your retirement years stress-free or constantly anxious about running out of money.

In fact, effective cash flow management is one of the cornerstones of best retirement planning services .

Here are the 10 most essential, India-specific, expert-backed strategies to help you manage your retirement cash flow like a pro.

Navigating retirement finances can feel complex—even for experienced investors. But whether you’re a seasoned professional or just starting out, I’m here to simplify one of the most crucial elements for long-term financial security: managing cash flow planning in retirement. With a clear, strategic approach, you can turn your savings into a steady, stress-free income stream that lasts a lifetime

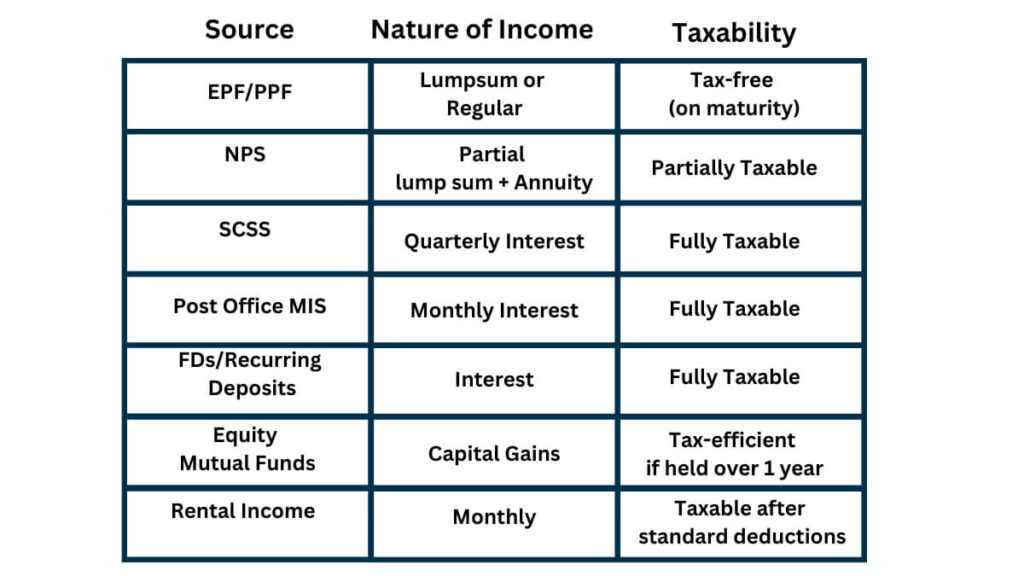

1)Understand All Your Retirement Income Sources

Your first step is to map out where your money will come from. Most Indian retirees have multiple income streams, such as:

Key Tip:

List all income streams and understand their tax impact. Use them with efficient tax planning :

- Withdraw from fully taxable first

- Then tax-deferred (mutual funds)

- Then tax-free (PPF)

This reduces your annual tax liability while extending the life of your corpus.

2) Create a Sustainable Withdrawal Strategy

(Don't Just Wing It)

How much can you safely withdraw each year?

- The old “4% Rule” suggests withdrawing 4% of your total retirement corpus yearly.

- But India has higher inflation and lower post-tax returns than the West.

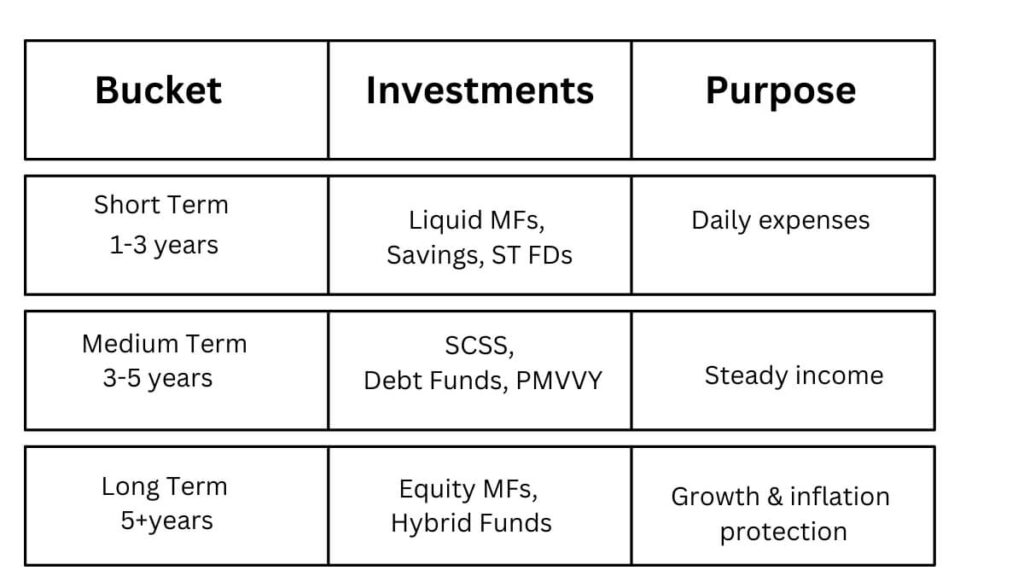

3)Better Approach: The Retirement Bucket Strategy

Divide your retirement corpus into 3 “buckets” called Retirement Bucket Strategy based on time horizon:

This ensures you always have money available—without touching growth assets in a downturn.

4) Eliminate High-Interest Debt Before You Retire

Debt can derail your golden years. Prioritize paying off

- Personal loans

- Credit cards (especially)

- Car and home loans (if feasible)

- Mindset Shift

Retiring without debt isn’t just a financial milestone—it’s a built-in raise for your future self, freeing up cash flow to support the life you’ve planned

5)Maintain Liquidity: Keep 12 Months of Expenses Handy

Avoid locking all your funds in long-term investments. Maintain access to:

- High-interest savings accounts

- Liquid mutual funds

- Short-term fixed deposits

Why? Market downturns can force you to sell at a loss if you don’t have liquid funds.

6)Build a Separate Emergency Fund

Retirement doesn’t mean the end of surprises

- Medical emergencies

- Home repairs

- Family obligations

- Recommended Amount:6 to 12 months of core expenses in a separate emergency fund—not mixed with your daily liquidity buffer.

Safe Parking: Sweep FDs, arbitrage funds, or ultra-short duration funds

7) Monitor and Adjust Your Spending Habits

The early retirement years (“go-go years”) often involve higher expenses. Regularly review

- Lifestyle inflation

- Unused subscriptions

- Discretionary spending habits

- Downsize your vehicle or home if underutilized

- Cap your travel and dining out budgets

8)Invest in Income-Generating, Low-Risk Assets

Retirement portfolios need to grow while generating stable income. Some ideal options:

Balance is key: Aim for growth (equity), stability (debt), and liquidity

9) Minimize Taxes to Maximize Cash Flow

The less tax you pay, the longer your money lasts—and the more you can enjoy your retirement.

Thanks to the new income tax regime, individual taxpayers can now earn up to ₹12 lakhs annually—completely tax-free, when factoring in standard deductions and rebates

What This Means for You as a Retired Couple

If both you and your spouse are senior citizens, your combined tax-free income can go up to ₹24 lakhs per year—that’s a solid ₹2 lakhs per month of clean, stress-free cash flow.

This income can be drawn from:

- Pension

- SCSS or PMVVY interest

- Post Office or bank deposits

- Rental income, etc.

Beyond ₹24L? Use Capital Gains Efficiently

For any additional income needs:

- Use Systematic Withdrawal Plans (SWPs) from equity mutual funds.

- SWPs after 1 year qualify for long-term capital gains (LTCG) taxation, which is more efficient—especially if your gains stay within the ₹1L exemption limit per year.

Tax Planning Tips:

- Split investments between spouses to double exemptions

- Use growth-oriented mutual funds to defer taxes until withdrawal

- Avoid large one-time redemptions that push you into higher slabs

10) Plan for Big Expenses in Advance

Whether it’s:

- Renovating your home

- Gifting money to children

- Going on a long-pending pilgrimage or international trip

Plan Ahead:

- Create goal-specific savings buckets

- Avoid large withdrawals during market downturns

- Distribute expenses across financial years

Timing Is Everything:

Don’t let one large withdrawal wreck your entire year’s income flow.

BONUS:

Review and Rebalance Your Retirement Plan Annually

Markets move, inflation shifts, and healthcare needs evolve. Your retirement plan must reflect these changes.

Annual Checklist:

- Rebalance your asset allocation

- Adjust for new income needs

- Modify spending in response to market movements

- Retirement is not set-and-forget. It’s a living plan.

Real-Life Case Study

How Ramesh & Sunita Secured a Stress-Free Retirement

Meet the Couple:

Ramesh (61): Retired PSU bank employee

Sunita (58): Retired private school teacher

Retirement Corpus: ₹1.8 Cr

Issues: No strategy, credit card debt, unclear withdrawal plan

Challenges:

- ₹12L home loan pending

- ₹4L in credit card debt

- No emergency fund

Confusion about where to withdraw from and how to sustain monthly needs

Our Solution:

With Wealthbeats Finserv, they received a complete cash flow makeover

Bucket Strategy Setup:

- ₹6L in liquid mutual funds for 1st year

- ₹30L in SCSS + debt funds for medium term

- ₹90L in hybrid equity funds for long term

Debt Clearance:

- Cleared home and credit card debt in 6 months

Emergency Fund:

- ₹5L parked in sweep FDs

Dream Fund:

- ₹4L earmarked for Europe trip at 65

Annual Review:

Regular reviews to adjust based on inflation and goals

Outcome:

- Monthly cash flow aligned to their budget

- No need to sell equity during market dips

- Enjoying family life and domestic travel worry-free

“We now feel confident, not confused. Our money is working harder than we ever did.” — Ramesh & Sunita

Conclusion: Take Control of Your Cash Flow, One Intentional Step at a Time

By following these 10 expert-backed steps, and working with a certified advisor, you can:

- Maintain your lifestyle comfortably

- Withstand market turbulence

- Leave a legacy, not liabilities

Ready for Retirement, The Wealthbeats Way?

We help Indian retirees build customized, tax-efficient cash flow plans so they can live life fully—without money worries.

Your golden years should be peaceful. Let us help you design them.

You can Contact on +91-9625565403

Contact Us

Table of Contents

Vineet Baheti, CFP

With over 14 years of experience in wealth management, I am expertise in comprehensive financial planning, including tax planning, retirement planning, and goal-based planning for High-Net-Worth (HNI) and Ultra-High-Net-Worth (UHNI) clients. As a Certified Financial Planner (CFP, Certification Number: IN94288), I provide personalized strategies to help clients achieve financial security, optimize their tax positions, and plan for a prosperous retirement. My approach is centered around building tailored financial plans that align with individual’s unique goals, ensuring their long-term financial success.