Retirement Bucket Strategy: The Smartest Way to Retire Without Worry

That peace of mind in retirement? It doesn’t come from luck. It comes from strategy—more specifically, the Retirement Bucket Strategy.

our retirement planning services are designed to help you implement the Bucket Strategy with confidence and clarity.

Whether you’re a decade away from retirement or already stepping into it, the Three-Bucket Strategy can help you build a stress-free, reliable income stream for life. In this guide, we’ll break it down into simple, actionable steps—and show you exactly how to use this powerful method to secure your financial future.

The world of retirement planning can be overwhelming. Even seasoned investors find it challenging to strike the right balance between stability, liquidity, and long-term growth

But whether you’re a financial expert or just beginning your retirement journey, I’m here to simplify one of the most effective strategies for managing cash flow in retirement : The Retirement Bucket Strategy

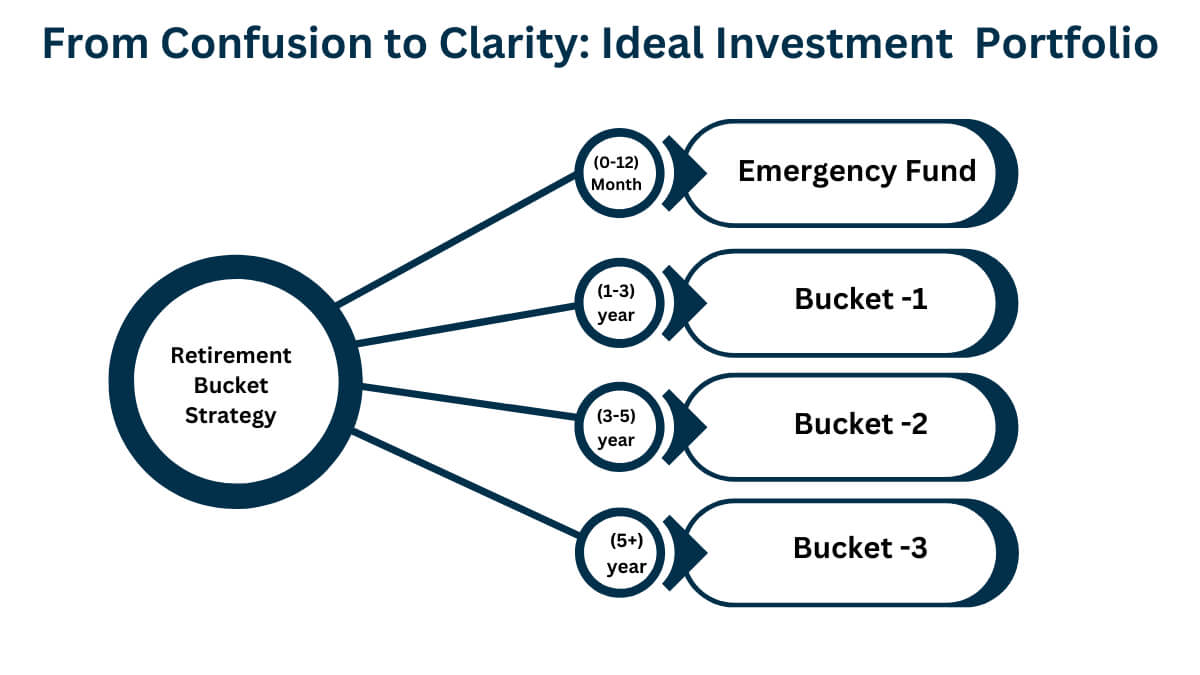

What Is the Retirement Bucket Strategy?

The Bucketing Strategy For Retirement divides your retirement savings into different “buckets” based on the asset class & category of funds. This segmentation allows you to allocate assets based on varying levels of risk tolerance and requirement for post-retirement cash flow planning.

Also known as the Three-Bucket Investment Strategy, this approach organizes your retirement savings into three segments or “buckets,” each designed to serve a different stage of retirement:

- Bucket 1: Immediate needs

- Bucket 2: Medium-term income & lifestyle

- Bucket 3: Long-term growth

By separating your savings this way, you gain clarity, control, and confidence—even when markets fluctuate.

Understanding the Three Bucket Strategy

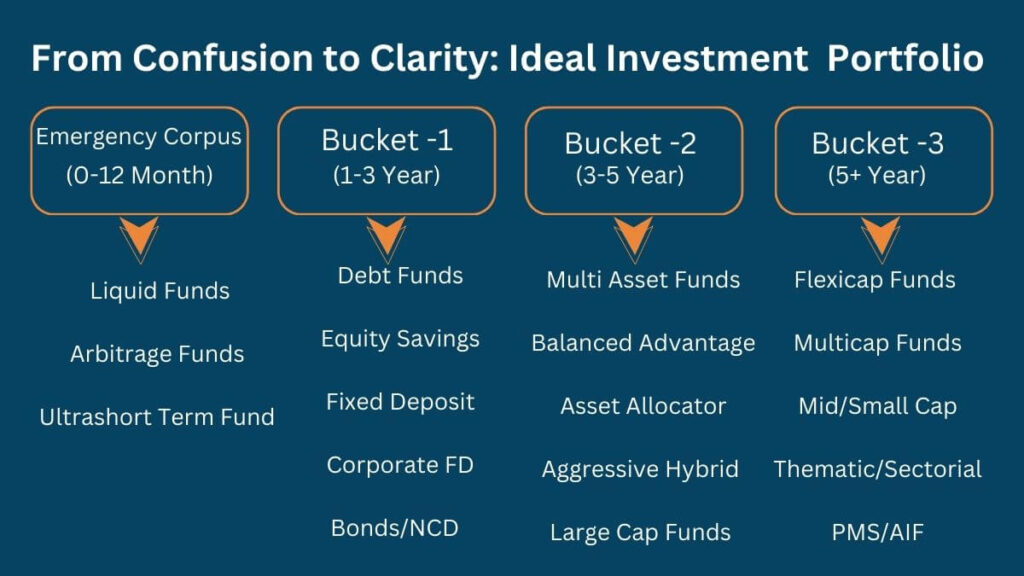

Bucket 1: Short-Term Safety (0–3 Years)

- Purpose: Capital preservation & regular income for household expenses

- Asset Allocation: Low-risk, fixed income instruments

- Investment Options: FD, SCSS, Corporate FD, RBI Bonds, PMVVY, PPF, Debt Mutual Funds, Tax-Free Bonds, SDLs, PSU Bonds

- Returns: ~7.5%–8.5%

- Cash Flow: Monthly/Quarterly pay-outs

- Taxation: Interest added to income (except PPF & Tax-Free Bonds)

- Strategy: Allocate a portion of your corpus here to receive consistent income. Supplement it with additional sources like pension, annuity, rental, and dividend income.

Total Income from Bucket 1 + Additional Income = Monthly Cash Flow (X) (for household expense)

Bucket 2: Medium-Term Growth (3–7 Years)

- Purpose: Generate inflation-adjusted cash flow through SWP

- Asset Allocation: Hybrid funds with equity, debt, gold, REITs/InvITs, overseas exposure

- Investment Options: Multi-Asset Funds, Balanced Advantage Funds, Asset Allocator FoFs, Aggressive Hybrid Funds

- Returns: ~10%–14%

- Cash Flow: Via SWP—Monthly/Quarterly

- Taxation: Capital gains, as per current equity taxation

- Strategy: Ensure SWP is less than expected returns. Enables capital preservation and compounding.

Income from Bucket 2 (SWP) = Additional Cash Flow (Y) (for discretionary expenses)

Bucket 3: Long-Term Wealth (7+ Years)

- Purpose: Maximize long-term returns and refill Bucket 1 & 2 periodically

- Asset Allocation: High-risk, high-return instruments

- Investment Options: Equity Mutual Funds, Direct Stocks, PMS, AIFs, Structured Products

- Returns: 12%–18%

- Cash Flow: Not for monthly needs—meant for long-term wealth accumulation

- Taxation: Capital gains, taxed as per equity norms

- Strategy: Leave untouched for compounding. Refill other buckets as needed.

The Refilling Strategy: Keeping Your Buckets Flowing

The Refilling Strategy ensures that your buckets never run dry by regularly replenishing them as funds are withdrawn. Here’s how it works:

- Refill Bucket 1: Every year or quarter, evaluate the performance of your long-term (Bucket 3) and mid-term (Bucket 2) assets. If your investments have grown sufficiently, transfer a portion of the profits into Bucket 1 to cover short-term needs for the next year or two.

- Refill Bucket 2: If Bucket 3 has performed well, allocate a portion of its gains to replenish Bucket 2 to maintain a balance of mid-term liquidity.

- Maintain Bucket 3: This bucket remains focused on long-term growth and continues to be invested in higher-risk assets to generate the returns needed to support future refills.

By refilling the buckets systematically, you maintain a steady stream of cash flow throughout retirement while keeping your assets aligned with your evolving risk tolerance.

Why This Strategy Works

- No panic during market dips: You have 2–3 years of income set aside

- Avoids selling in bad markets: You withdraw only from stable buckets

- Adaptable to your lifestyle: Conservative or growth-focused

- Provides psychological peace: Each rupee has a purpose

Real-Life Scenario:

Ashish and Priya’s Retirement Bucket Strategy Plan

Ashish (62) and Priya (60) have ₹2 Crores in retirement savings. To plan a secure 25+ year retirement:

- Bucket 1: ₹30 Lakhs in low-risk, income-generating assets

- Bucket 2: ₹60 Lakhs in hybrid funds for moderate growth and income

- Bucket 3: ₹1.1 Crores in equity funds for long-term growth

Result: They enjoy steady income today—and peace of mind about tomorrow.

“From Stability to Growth: My Experience with the Bucketing Strategy in Navigating Market Uncertainty During Retirement. if you want to secure your retirement with a solid plan, mastering this strategy is the key.”

Retirement Bucket Strategy is a game changer for your future .

How to WealthBeats Build Your Retirement Bucket Strategy

Step 1: Calculate Your Annual Expenses

Step 2: Set Up Bucket 1 for 2–3 Years of Basic Needs

Step 3: Bucket 2 for Medium-Term Growth and Reliable Income

Step 4: Allocate Bucket 3 for Long-Term Growth & Future Security

Step 5: Rebalance Annually—refill Bucket 1 & 2 from Bucket 3 gains

Why the Retirement Bucket Strategy is a Game-Changer

Retirement isn’t a finish line—it’s a financial marathon.

And running out of money mid-race is every retiree’s worst nightmare.

That’s where the Retirement Bucket Strategy changes the game. It’s not just another planning tactic—it’s a psychological and financial shift that helps retirees thrive, not just survive.

Now, here’s why it’s a game-changer:

1)Reduces Emotional Decision-Making

When markets crash, retirees panic.

But the bucket strategy protects near-term needs from volatility, so your clients don’t have to touch long-term investments during market dips. It acts as a built-in emotional shock absorber, minimizing fear-based selling.

Result: Better financial decisions and higher portfolio longevity.

2. Aligns Time with Risk—Perfectly

Traditional asset allocation blends everything together. The bucket approach time-segments risk: safer assets fund the short term, while higher-risk investments are left to grow uninterrupted for the long term.

Result: A smoother, more sustainable withdrawal path, with better compounding potential.

3. Creates Predictable Cash Flow

Many retirees struggle to transition from a saving mindset to a spending one. The Retirement Bucket Strategy addresses this head-on. Buckets act as a structured “paycheck replacement” system—especially Bucket 1, which ensures there’s always liquidity for everyday expenses. This not only supports day-to-day confidence but also becomes a foundational tool for managing cash flow in retirement—helping retirees avoid overspending, under-spending, or emotional financial decisions.

Result: Peace of mind and freedom to enjoy retirement without income anxiety.

4. Makes Retirement Planning Tangible & Visual

Telling a client “You’ll be fine with a 60/40 portfolio” means little. But showing them their income mapped across 3 buckets? That’s real. It builds trust and understanding.

Result: Clients feel in control, making them more likely to stick with the plan.

5. Mitigates Sequence of Returns Risk

The biggest threat early in retirement isn’t average return—it’s when losses occur. The Bucket Strategy shields critical early withdrawals from market downturns, buying time for recovery in growth assets.

Result: Stronger portfolio survival rates, especially in volatile markets.

6. Customizable & Adaptable

No two retirements are alike. The Bucket Strategy is highly flexible—it can be personalized to support goal-based planning, accommodate evolving lifestyle and health needs, and align with long-term legacy planning objectives, ensuring that your retirement reflects what truly matters to you and your family.

Result: A more human-centered approach that grows with changing needs.

7. Builds a Discipline of Rebalancing

The strategy encourages regular reviews and smart rebalancing. As growth assets perform, profits are trimmed and replenished into lower-risk buckets—automating a “sell high, buy low” cycle.

Result: Enhanced long-term returns through systematic discipline.

Mindset Revolution, Not Just a Math Fix

The Retirement Bucket Strategy isn’t only about investments—it’s a lifestyle management framework. It blends logic, emotion, and strategy into a retirement income plan that feels intuitive while being deeply effective.

Pro Tips to Maximize Your Retirement Bucket Strategy

✔ Use SWPs for consistent tax-efficient income

✔ Invest in tax-efficient equity funds in Bucket 3

✔ Account for inflation—adjust every 2–3 years

✔ Add annuities for ultra-low-risk guaranteed income

✔ Always keep your SWP rate < return rate

Common Mistakes Retirees Can Avoid

- No withdrawal strategy → Cash flow chaos

- Withdrawing too soon → Run out of money early

- Ignoring taxes → Paying more than needed

- Avoiding growth assets → Can’t beat inflation

- Not rebalancing → One bad year can derail the plan

Final Thoughts: Retirement Bucket Strategy = Security

The Retirement Bucket Strategy is more than just a financial method—it’s a retirement lifestyle framework.

It provides:

- Safety – Your immediate needs are protected in low-risk instruments.

- Liquidity – Immediate availability for planned or unexpected needs.

- Cash Flow Clarity – A structured payout mechanism avoids cash crunch.

- Investment Discipline – Keeps emotions in check during market swings.

- Mental Peace in Volatile Markets – Helps you stay invested in the long run without panic.

- Tax Efficiency – Optimizes tax outgo through strategic investment choices.

Ready to Build Your Retirement Bucket Plan?

We’re here to help.

👉 Book Your FREE 30-Minute Retirement Planning Session with Wealthbeats Finserv Today

Let’s build a retirement that’s not just secure—but fulfilling.

FAQ:

You can be confident that your bucket strategy will work after retirement when it’s built on a foundation of realistic planning, strategic asset allocation, and flexibility. By dividing your savings into time-based buckets—short-term for immediate needs, mid-term for stability, and long-term for growth—you create a structure that balances income with market risk. Regular reviews and rebalancing ensure your plan stays aligned with your goals and adjusts to market changes. This layered approach not only helps weather market volatility but also provides peace of mind, making it a sustainable and smart strategy for long-term retirement income.

The top three items to include first on your retirement bucket list should be those that offer the most personal meaning, time-sensitivity, and impact. Here’s what most retirees prioritize early:

Travel to a Dream Destination

Do it while health and energy are at their peak—especially if it’s long-haul or adventurous.

Pursue a Passion or Hobby

Reignite interests you never had time for—like painting, music, gardening, or golf.

Spend Quality Time with Loved Ones

Plan special experiences with family or close friends that create lasting memories.

The Bucket Retirement Strategy could be the right fit for you if you’re seeking a structured yet flexible approach to managing your retirement income with peace of mind. This strategy divides your retirement savings into separate “buckets” based on time horizon—short-term for immediate expenses, mid-term for stability, and long-term for growth. It’s especially suitable for those who want to reduce the emotional impact of market volatility while ensuring consistent cash flow. If you value clarity in your withdrawal plan, prefer a safety-first mindset for near-term needs, and still want to grow your wealth over time, the bucket strategy offers a balanced and personalized solution that adapts as your retirement evolves.

Yes, the bucket strategy is designed to adjust as your life changes. Its flexible structure allows you to rebalance your buckets based on evolving needs, market conditions, or personal milestones. Whether it’s unexpected healthcare costs, lifestyle changes, or shifting goals, you can update your allocations to stay aligned with your financial plan. This adaptability makes the bucket strategy a resilient and practical approach to managing retirement income throughout every stage of your life.

The 3-bucket strategy for retirement is a time-tested financial planning approach that segments your retirement savings into three distinct “buckets,” each serving a specific purpose based on your spending timeline and risk tolerance. As a financial industry expert, I can tell you that this method not only simplifies income planning but also strategically balances safety, stability, and growth.

Bucket 1 – Short-Term Needs (0–3 years)

Bucket 2 – Medium-Term Needs (3–7 years)

Bucket 3 – Long-Term Growth (7+ years

Contact Us

Table of Contents

Best Retirement Planning Services

Vineet Baheti, CFP

With over 14 years of experience in wealth management, I am expertise in comprehensive financial planning, including tax planning, retirement planning, and goal-based planning for High-Net-Worth (HNI) and Ultra-High-Net-Worth (UHNI) clients. As a Certified Financial Planner (CFP, Certification Number: IN94288), I provide personalized strategies to help clients achieve financial security, optimize their tax positions, and plan for a prosperous retirement. My approach is centered around building tailored financial plans that align with individual’s unique goals, ensuring their long-term financial success.